Cool Tips About How To Get A Ein Number

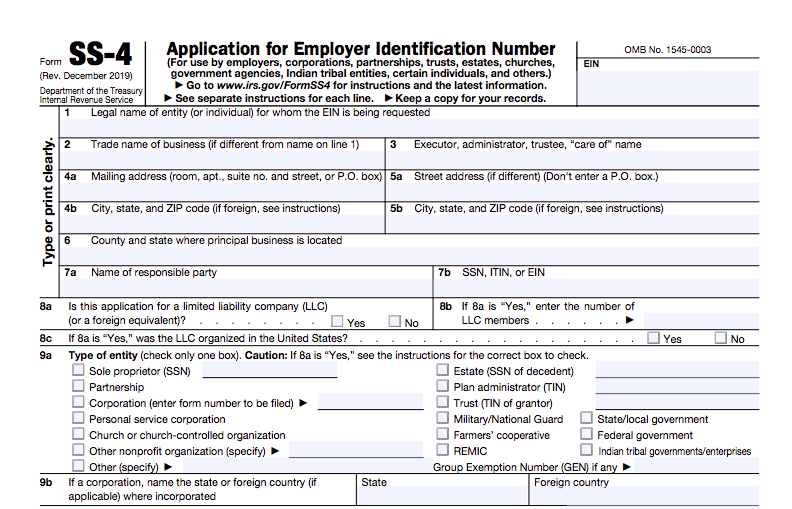

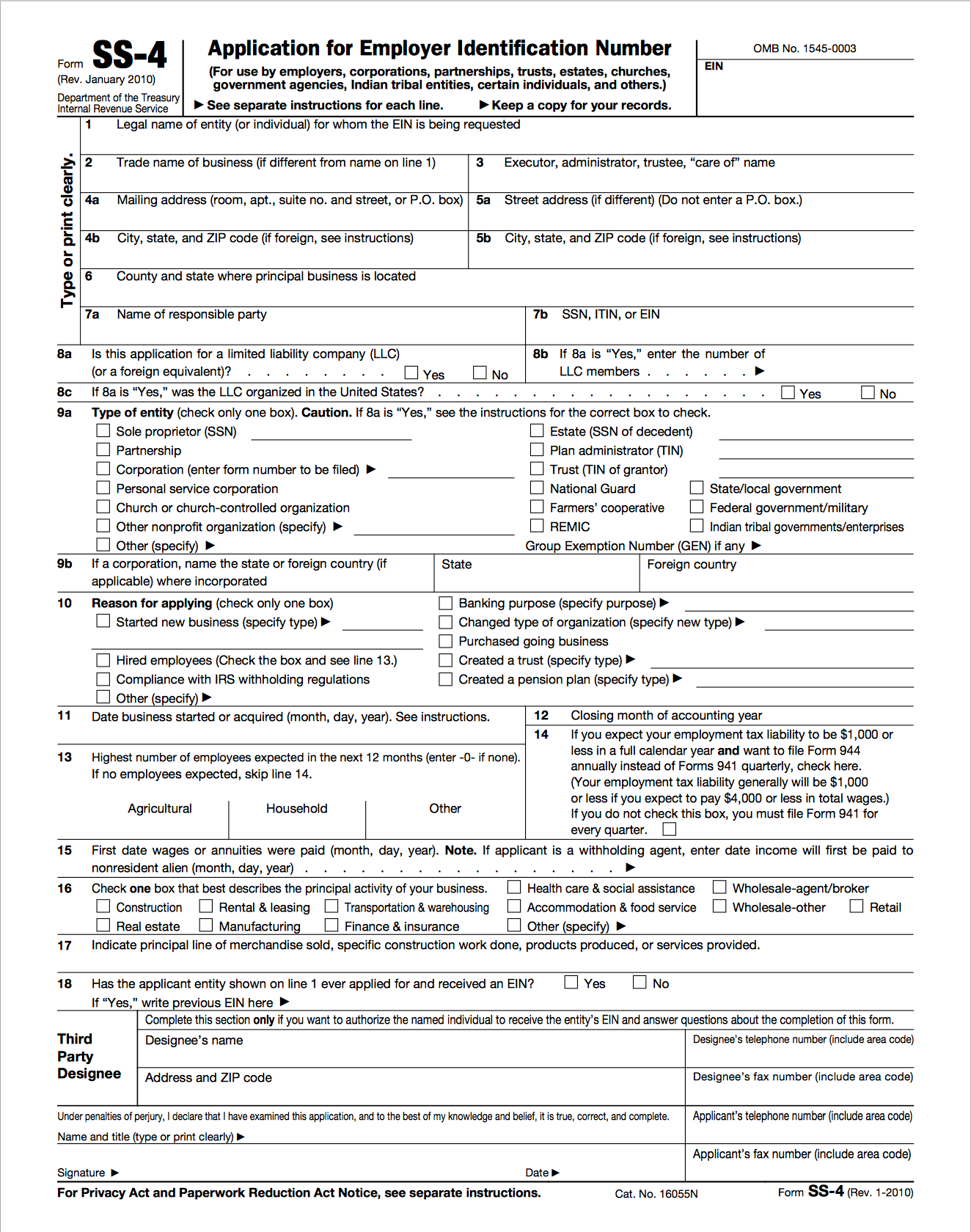

An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity.

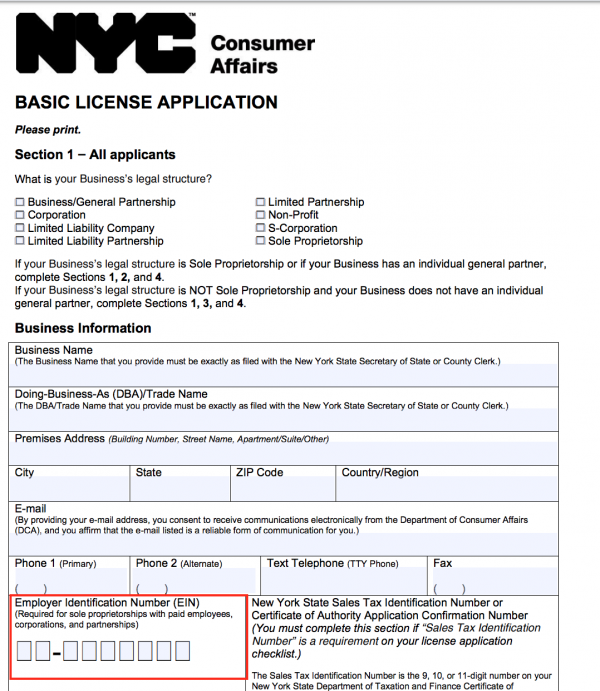

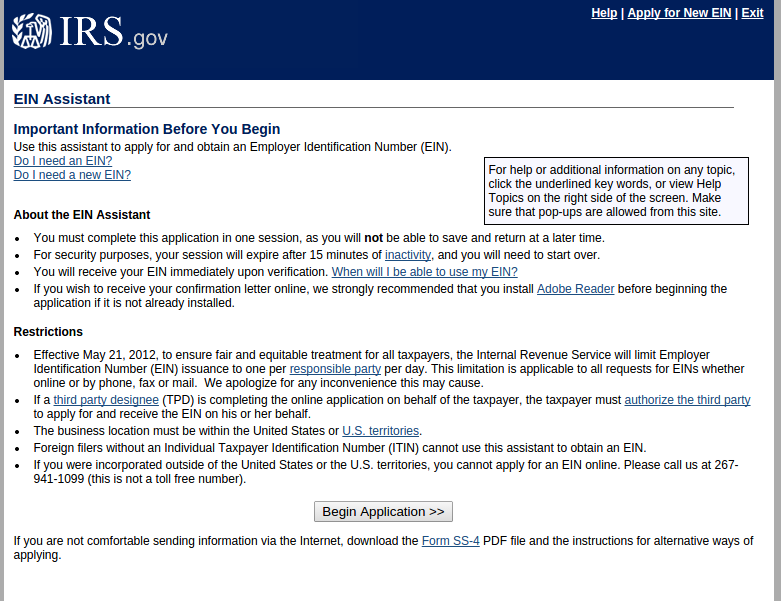

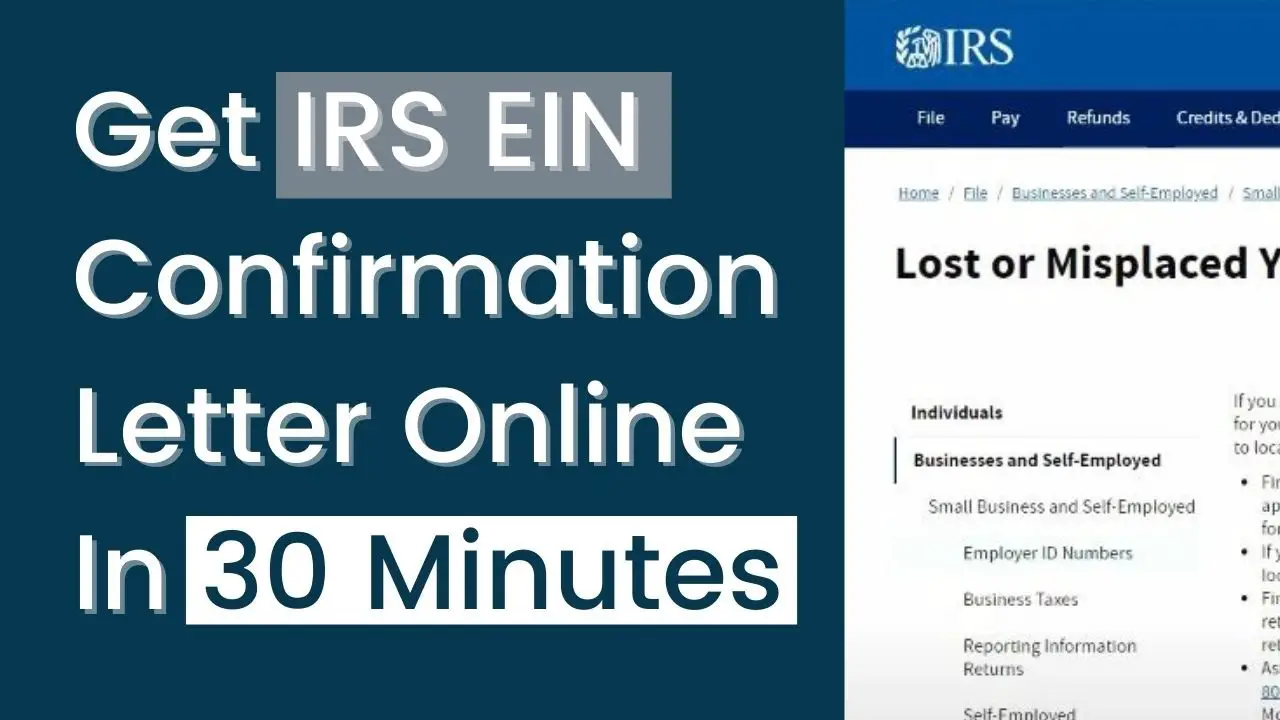

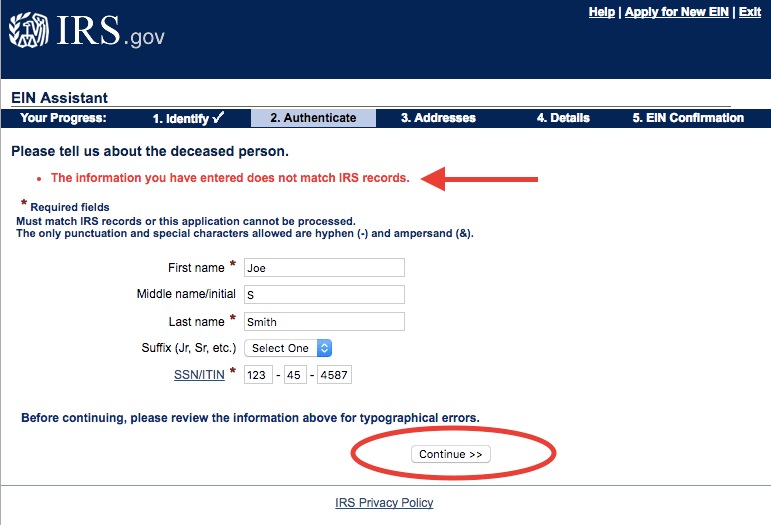

How to get a ein number. The person applying online must have a valid taxpayer identification number (ssn, itin, ein). So, specifically the first step to getting an ein is to go here. You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits.

Choose a backup method. This is the original document the irs issued when you first applied for. The ein is a unique number that identifies the organization to the internal revenue service.

South carolina voters head to the polls today to choose the gop nominee for president. If you reside in the united states, you cannot apply for your ein over the telephone. You must have a valid ssn or itin to apply for an ein at the irs website.

The irs recommends waiting until. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help remind taxpayers of key items they’ll need to file a 2023 tax return. You can apply for an ein online through the irs website and get your number in minutes.

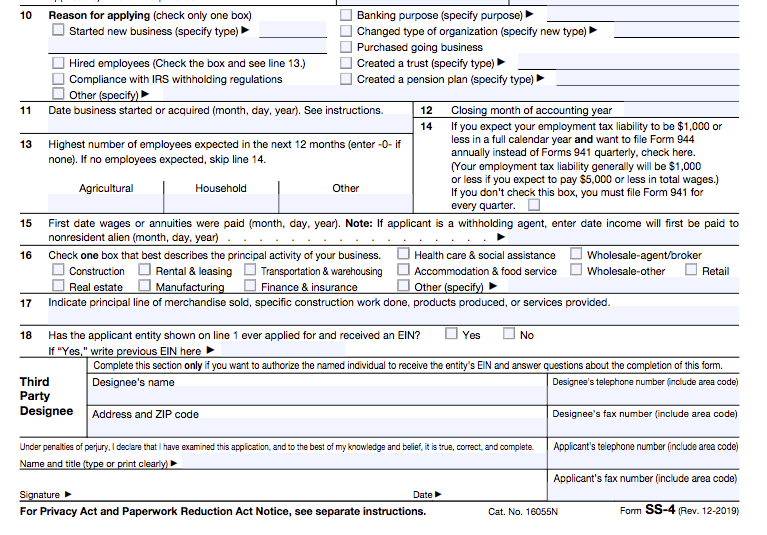

Applying over the telephone: You may apply for an ein online if your principal business is located in the united states or u.s. Some third parties will apply for an ein on your behalf, and charge you for the service.

Back up with your mac. Filing online using the irs ein assistant online application is the easiest way. Before you get started, learn the difference between icloud backups and backups you make using your computer.

It's used to identify the tax accounts of employers and certain others who have no employees. Here is how to lookup your business's ein online Learn how to get an employer identification number.

(eastern time), monday through friday. It is free and easy to do. Determine if you need an employer identification number (ein) by answering these questions.

If you previously applied for and received an employer identification number (ein) for your business, but have since misplaced it, try any or all of the following actions to locate the number: You’ll use it when filing your business's income tax return or payroll tax return. Then choose the method that's best for you.

Back up with your pc. You can apply to the irs for an ein in several ways: Any business with employees must have an ein for tax purposes, which is obtainable free from the irs.

-Step-9.jpg)