Amazing Tips About How To Manage Family Budget

Create savings goals for the future.

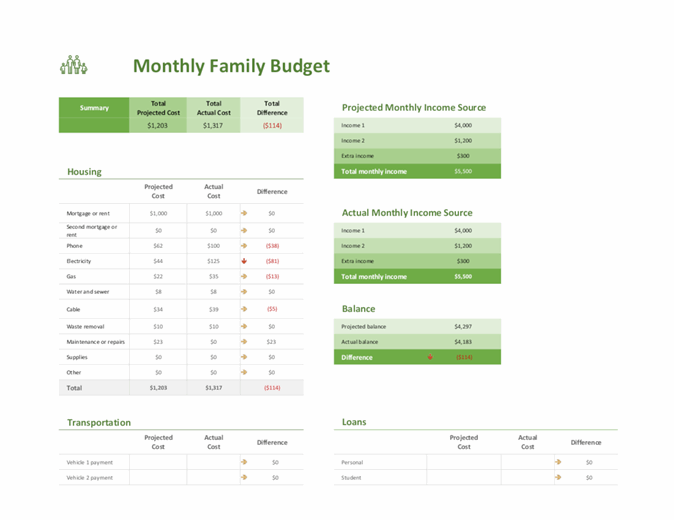

How to manage family budget. Before starting to create a budget for various expenses, you need to know in advance how much total. Hello, money goals. Slash spending, boost savings and pay off debt by creating a realistic budget.

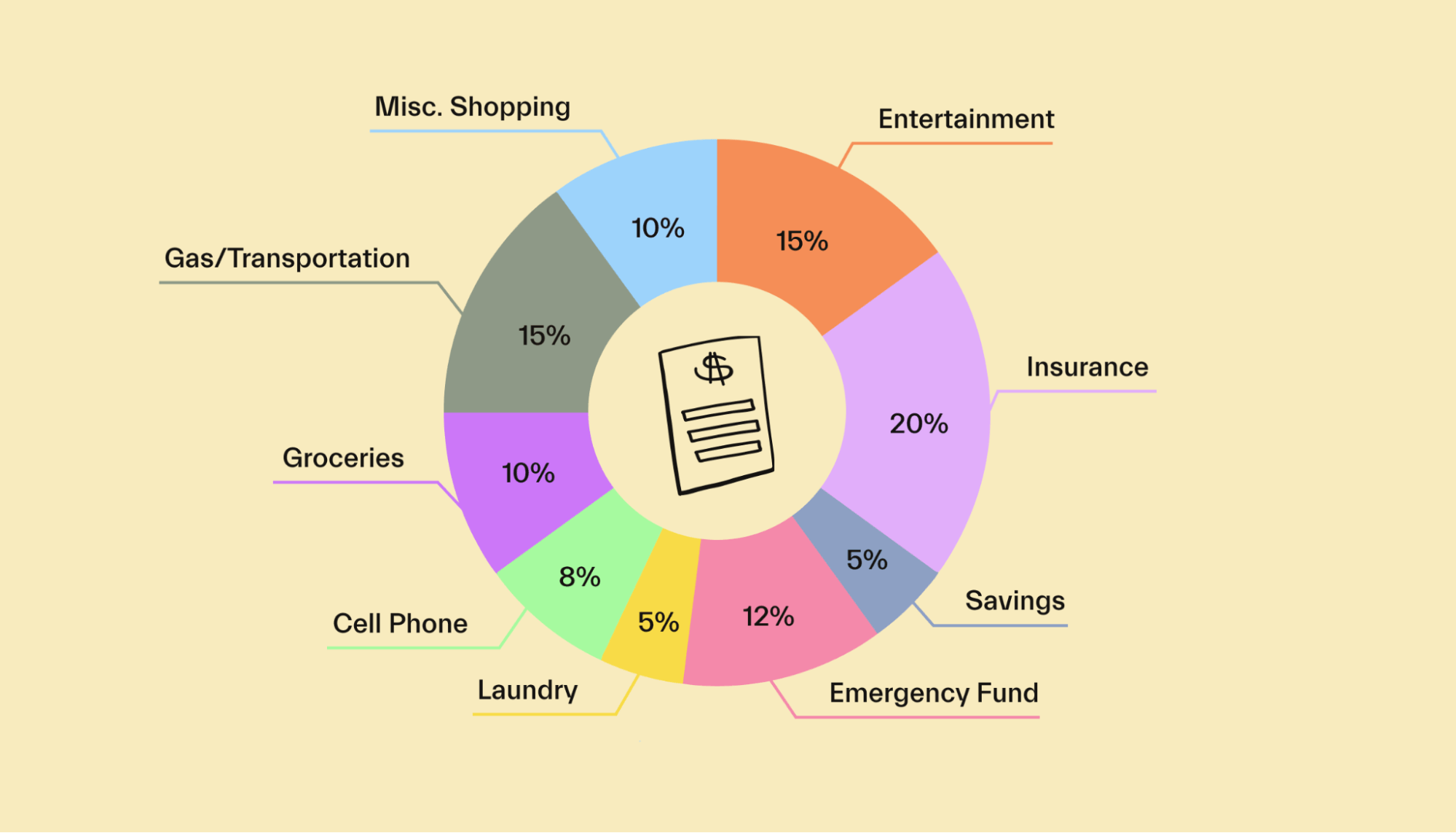

How to manage family finances. Using a worksheet or application. An example of budgeting from the life of one family.

Why tracking your spending is the key to budgeting. Table of contents. Gather bank statements, household bills and receipts.

It’s now paying consulting firm prismatic services, inc. Diligent budgeting is one of the key steps that you can take to protect your family from the worst. What rules must be followed when managing a family budget.

Understanding what a family budget is and the fundamentals of the family budget, the family budget, is a plan for your. How to create and maintain a family budget. Virginia’s largest school division first said it was considering making the change last year.

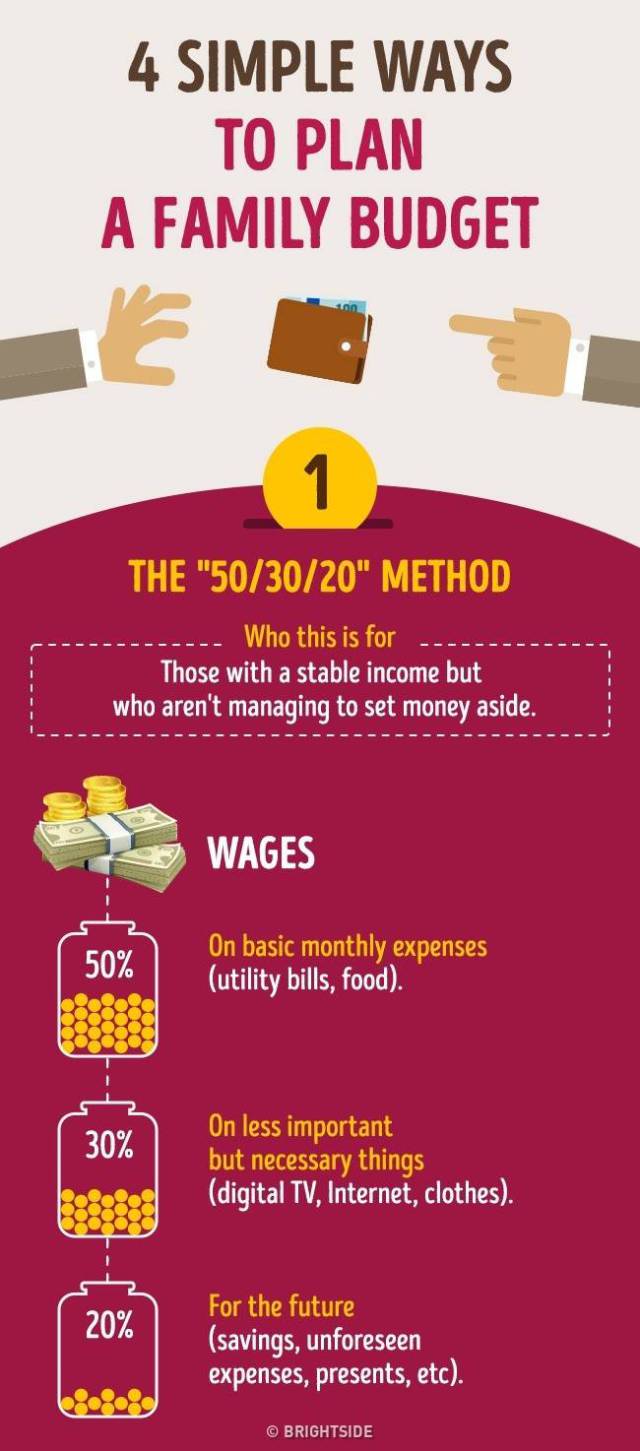

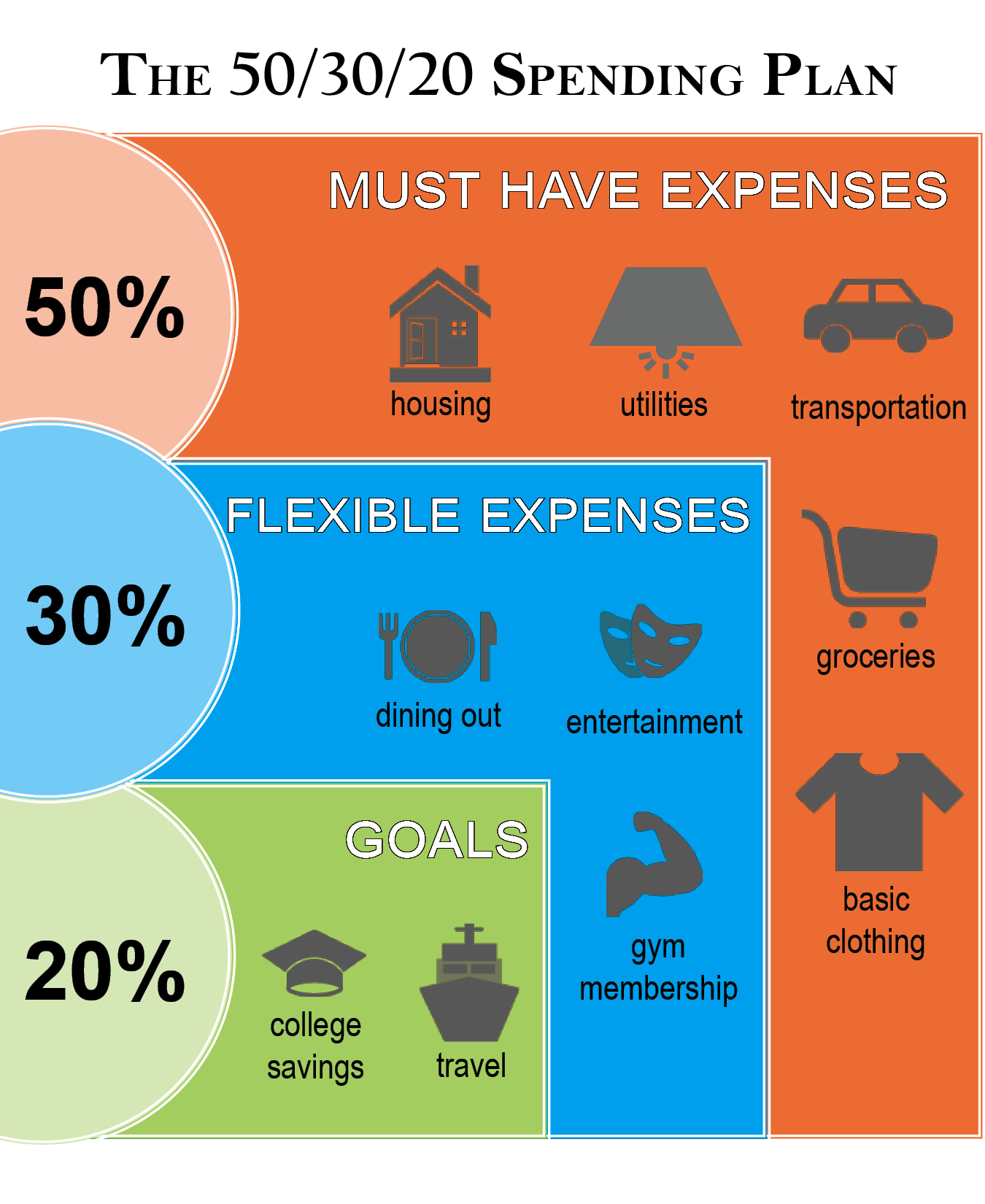

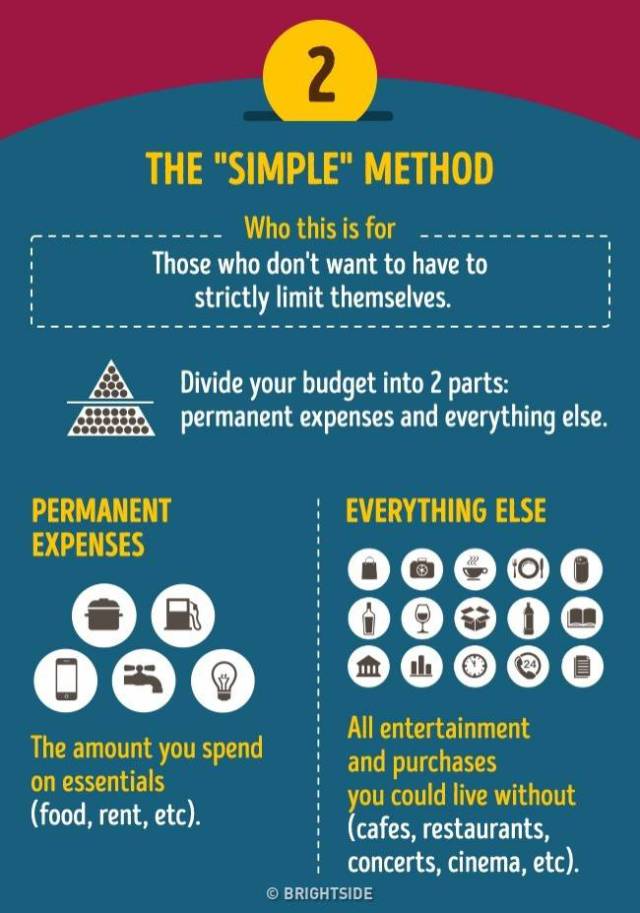

8 steps for how to create a family budget that actually works. 4 ways to manage a family budget. A family budget is essential to managing your money.

Whether you are struggling to make ends meet, wanting to pay off debt or saving for the future, drawing up a family budget is the best way to manage. That’s because a family budget helps you: How to create a family budget.

Start by gathering up all of your financial info—things like income statements, bank statements, credit card statements, and bills. An effective family budget hinges upon a foundation of precise and comprehensive data. Without a clear understanding of.

What is a family budget? 3 saving for life goals. After you create a household budget and figured out what your financial situation is, it’s a really good idea to set some savings goals.

Updated june 26, 2023. Gather necessary financial documents. Written by tyler smith.